Such was the title of a debate held at the Asia Society, sponsored by Thomson Reuters, which I attended several weeks ago. Coming at a time of agonizing societal fissures arising from debates over austerity, stimulus, and the wisdom of government intervention into the economy, this event pitting the backers of a Hayekian view of economics against those who espoused a Keynesian model seemed incredibly timely. After explaining to the audience the general structure of the debate and how it would be judged-spectators were given gadgets similar to those distributed at IQ2 debates, which they were to use to vote for the side they agreed with at the beginning and conclusion of the debate-Harold Evans and Nicholas Wapshott, author of Keynes Hayek: The Clash That Defined Modern Economics, limned the underlying philosophical division that gave rise to this debate.

As the introductory remarks made clear, the 80 year-old clash between Keynes and Hayek was “one of the most vituperative divisions in economics,” and the fact that this debate still carried resonance many years after the deaths of both men demonstrated the pertinacity of both schools, which reflected in some measure the confidence that both men had that their views reflected the definitive understanding of how economics works at an empirical level. Despite the deep esteem in which Hayek held the world-renowned English economist as a young man in post-war, inflation-wracked Austria-Keynes was celebrated throughout the territory of vanquished Central Powers for his anti-Versailles manifesto, The Economic Consequences of the Peace-he would eventually become the chief intellectual antagonist of Keynes among neo-classical, liberal economists.

Although attempting to synopsize either man’s complex body of work into a few sentences is impossible, it’s generally understood that where the two men differed was in their philosophies about economic growth. Whereas Hayek was adamantly opposed to the easy money policy pursued by some central banks and felt that inflation was the primary scourge of humanity, Keynes believed that deflation and mass unemployment were more pressing concerns. He felt that there were moments in history where a misallocation between supply and demand because of microeconomic actions led to recession and unemployment. Therefore, the government needed to spur demand in certain sectors of the economy whose stagnancy could not be sufficiently addressed by the free market.

This point was emphasized by one of the Keynesians in particular, Steven Rattner, who most of you might remember as President Obama’s car czar. Others might remember him chiefly for the 10 million dollar settlement he was forced into by Andrew Cuomo after a lengthy SEC investigation involving his private equity firm, Quadrangle. Either way, he maintained that, despite his abiding faith in capitalism, there were moments in history when the government needed to rescue the free market from itself. His chief example of such a case was the large federal bailout of failing Detroit auto-makers Chrysler and General Motors, which he supervised. Rattner asserted that the domestic auto industry would have collapsed, had it not been for the direct intervention of Congress and the White House in 2008 and 2009. The capital markets were simply not willing to lend to GM or Chrysler, with the result being that both companies faced imminent bankruptcy-and their suppliers a similarly parlous fate-if the government did not step in to save both corporations with a desperately needed line of credit. In this case, one extended at the expense of American taxpayers.

It should be noted that the federal government’s response to what Rattner described as a “market failure,” but which his Hayekian opponents-during the question and answer period-labeled a “market verdict,” has come in for criticism from both the left and the right. This critique of the actions by Washington D.C., at least from a Hayekian perspective, is remarkably similar to the criticism leveled against the New Deal policies Keynes played a large role in shaping during the Roosevelt administration. Namely, that the government does not have enough knowledge, and certainly hasn’t the right tools, to redress structural, macroeconomic problems such as unemployment and deflation. Even if there is a place for government intervention-and James K. Galbraith, the lead debater for the Keynesians, was quick to specify all the areas in which Hayek believed the government should play some role-it must recognize the inherent danger of trying to manipulate economic outcomes.

The two most critical areas where that danger manifests itself are fiscal stimulus in the form of deficit spending, which inevitably leads to a greater debt to GDP ratio, and the inflation that results from monetary easing. These were also the two areas that came in for the most criticism from the Hayekian side. In particular, Manhattan Institute economist Diana Furchgott-Roth, who pointed out that our current debt to GDP ratio was higher than at any time in this nation’s history since the Second World War. She also took aim at a report co-authored by former Obama administration officials Christina Romer and Jared Bernstein, which attempted to predict future unemployment rates both with and without the American Recovery and Reinvestment Act, otherwise known as the Stimulus Bill. Romer-then in charge of President Obama’s Council of Economic Advisors-famously predicted that without the stimulus plan the unemployment rate could rise as high as 8.8%. Of course, our currently unemployment rate, stimulus included, well exceeds that figure.

Sylvia Nasar, a business journalist who teaches business journalism at Columbia University, countered that monetary policy is more effective in dealing with problems like persistent unemployment, citing the work of Milton Friedman, probably the most emblematic monetarist of the latter half of the 20th Century. She also invoked the examples of pre-WWII Sweden and Japan, neither of which experienced the deep economic depressions of Western Europe and North America, yet both of which ”ignored Hayek’s advice” with regard to monetary policy. Nasar insisted that there was a deep correlation between monetary stimulus and economic recovery, using the two examples above as evidence that determined policy had prevailed against “nature’s cure” in the realm of ideas. This raised yet another point of contention during the debate, which was the Keynesians’ accusation that their Hayekian opponents were complacent do-nothings who had no concrete plan to address pressing macroeconomic dilemmas such as unemployment.

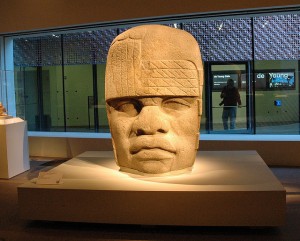

Lawrence H. White, an economics professor at George Mason University, vigorously disputed this assertion, noting that Hayek advocated constancy in the money supply when advising central banks, and advocated the maintenance of nominal spending in order to avoid deflationary spirals. Even so, White reiterated the Hayekian critique of fiscal stimulus, reasserting a classical liberal maxim that we “don’t undertake public works whose costs exceed their benefits.” This jab was aimed at the public infrastructure investment envisioned by the Obama stimulus package, which Diana Furchtgott-Roth described as a thinly-veiled payoff to President Obama’s supporters among organized labor. In a swipe at an iconic passage from Keynes’s General Theory of Employment, Interest, and Money, White summed up his contempt for this sort of public investment for the sake of stimulating the economy by asserting that “we can’t restore prosperity by having the government build pyramids.” This, in turn, prompted a retort by one of the Keynesians that the construction of the Giza pyramids was an abundant source of jobs for Egyptian laborers. Hence, a boost for the economy of Egypt.

In addition to the standard Hayekian critique that this sort of fiscal stimulus debases the currency, and therefore impoverishes the standard of living, White also tackled what most feel is the proximate cause of the 2008 economic crisis. Namely, the burst of the housing bubble. He claimed that “we had permanently reduced our living standards by over-investing in real estate during the economic boom.” John Cassidy, a staff writer for The New Yorker and perhaps the most solidly anti-Hayek speaker on the Keynesian side, also identified the cause of America’s economic as being the collapse of the housing market, but assigned blame to the private sector. He dismissed the Austrian diagnosis of the causes of the collapse, asserting that the Community Reinvestment Act had little to with the skyrocketing foreclosure rate, and the culpability of GSEs like Fannie Mae and Freddie Mac was minimal when compared to the exposure of private sub-prime lenders who engaged in reckless lending and catastrophically bad or ill-timed investments. Cassidy went even further than most of his colleagues on the Keynesian side, asserting that “Hayekianism is not even a distinct policy doctrine,” and that Hayek himself “gave up the debate with Keynes about macroeconomics.” Cassidy wrapped up his remarks by quoting current chairman of the House Budget Committee Paul Ryan, who at a congressional hearing during the 2001 recession encouraged deeper tax cuts that would “juice the economy.” Cassidy, echoing the sentiment of other Keynesians, such as Ezra Klein, claimed that this statement demonstrated the resonance of stimulus spending, even among those who would reject the label of Keynesianism.

For his part, Stephen Moore agreed that tax cuts were an integral component of economic growth. However, he rejected the notion that Keynesianism was responsible for the economic growth the United States experienced during the 1980s. Using September 1983 as a benchmark, since it was the same point in the Reagan presidency as we are experiencing in the Obama presidency, he contrasted that month’s employment figures, which saw the creation of over 1.1 million jobs and a third quarter growth rate of 8.4%, with the anemic growth our economy is currently experiencing. Moore also pointed out that the Paul Volcker-led Federal Reserve had applied precisely the Hayekian remedies that the other side decried, yet his constriction of the money supply not only slayed the inflationary dragon but seemed to disprove the Keynesian assumption-voiced by Keynes followers like Sylvia Nasar-that monetary easing was inextricably linked with economic growth and robust employment. At the same time that Moore praised the policy prescriptions adopted by President Reagan, he faulted his inability to encumber spending by Congress. Of course, John Cassidy took a contrary view, asserting that David Stockmam’s failure to rein in discretionary spending as Chairman of the Office of Management and Budget was a boon to the U.S. economy. He also claimed that the tepidity of the current economic recovery should be attributed to the decline in spending at the state and local level, which is commensurate with the rise in spending at a federal level.

Perhaps the most intriguing statement made during the course of the hour and a half-long debate was the claim by James K. Galbraith that “the United States is not in a debt trap; debt levels, by historical standards, are not that large.” While this might seem like an implausible claim when viewed in the context of a national debt that eclipses 14 trillion dollars, and a government whose payment obligations range from 100 to 200 trillion dollars, it is not an entirely aberrant perspective. In fact, there is a rather popular book whose author attacks the very notion of retiring the national debt.

What was surprising about this debate was the willingness among some of the Hayekians to countenance government intervention into the economy, although perhaps it shouldn’t have been considering the political views of Hayek himself, who supported numerous interventionist policies during his lifetime. To the chagrin of my anarcho-capitalist friends in the audience, Edmund Phelps-a 2006 Nobel laureate in Economics-repeatedly emphasized areas in which he supported government intervention into the economy, at one point during his closing statement even rejecting the label of “Hayekian.” During his opening remarks, he made the point that the depressions experienced by Keynes were monetary in origin-signaled by rapid deflation-and that, as a response, monetary policy had to be altered. Since the economy in our current financial crisis initially faced what was essentially a liquidity problem, “the Keynesians were right to urge the Fed to increase demand for money.” Phelps contended, however, that since today what we are facing is a “structural slump” Keynes’s theory of employment was not applicable. In addition to supporting the first round of quantitative easing undertaken by the Federal Reserve, in his closing remarks Phelps seemed to imply that portions of the jobs’ plan put forth by President Obama were worthy of consideration.

I’m not sure if it was this nuance that led to the ultimate result, but at the conclusion of the debate a slim majority, 52% of the audience, professed themselves to be “pro-Keynes.” It should be noted, however, that this was only an increase of 5% from the outset of the evening’s debate, whereas the “pro-Hayek” side of the ledger gained the support of an additional 9% of the crowd, from a starting point of 33%. The Hayekian interpretation of this result is that the anti-Keynes forces were more persuasive in making their arguments, although strategic voting might have also played a role. In either case, I think the debate over whose ideas are more sound will persist for some time. Perhaps it will even be expanded to include an even more consistently anti-state Austrian viewpoint that will satisfy my disenchanted anarcho-capitalist friends.

Mises vs. Fisher anyone?

And the search for the ” unification theory” continues. Even Malthus and Henry George got some of it right. While free market economics has been proved to be the foundation of economic theory as Einstiens general theory of relativity is to physics, the effort to quantify the effects of micro and macro management have fallen short. The human inability to put ideology aside and simply stick to the empirical facts will always place more weight on the theory rather than the proof supporting the hypothesis. Einstein went to his death rejecting quantum Mechanics , consider the advancement possible had he had a more open mind and not fallen prey to his own Ego.